I talk a lot about how to save money, that's because saving money is one of the key ways to get a better credit score. Not living pay check to paycheck it being in debt is key to financial well being. Saving pennies here and there may not seem as if it's doing much, however, in reality it is.

It is important to review your credit on a regular basis. It is free to contact (online or over the phone) the 3 major Credit Bureaus; Equifax, Trans Union, Experian. Not only is there a good chance that your score and credit history is being effected by incorrect information, but there could also be fraud. Keeping up on your information and making sure you know what is being reported to whom is extremely important. If you find errors on your reports it is WORTH going through the dispute process and getting those items removed.

Most people are not aware that having their credit checked will actually lower their credit score. Even fewer are aware that this "ding"or inquiry adheres to your credit remains a harmful occurrence for 2 years. Be extra careful when purchasing items such as a car. When the dealerships "shop" around to get you financed, they are actually having your credit repeatedly ran thus causing you harm in the form of inquiries.

Having an extra few dollars to put on a bill can save you hundreds, even thousands. This lowers your debt to income ratio, thus showing you as less of a risk on your credit report. Also paying even just a few dollars over the minimum amount will allow your credit score to soar.

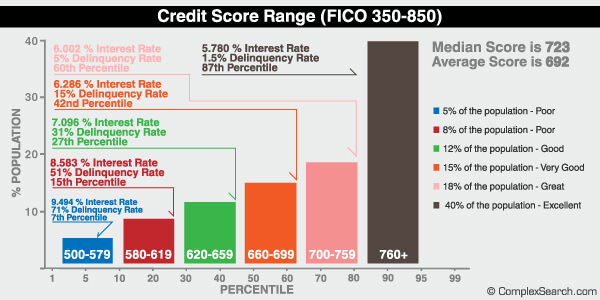

This spurs the question of "how". How can paying more help your credit and credit score? It's simple really. When you apply for credit and you have many open revolving lines of credit with high balances you appear to lenders as a liability and a risk. They as less likely to lend to you they want your money, the don't want to have to send you to collections or write off the balancing owing on your debt. So instead the credit lender will either deny the loan all together

or offer you a small loan with a high return for them, aka exorbitantly

high interest rate.

The more you know about how credit works and how having lines of credit effect you and your life, the more you can start living and stop watching yourself go deeper into debt.

The more you know about how credit works and how having lines of credit effect you and your life, the more you can start living and stop watching yourself go deeper into debt.

No comments:

Post a Comment